I am not sure that there is anyone who hasn't been affected in some way by the cost of living crisis. So in this post I am sharing how we as a family are managing some of the surprises that the world is throwing a us and some budgeting ideas.

Inflation has been kicking many. The rate in the US as I write this is 3.1% and in the UK its hovering around 4%. The impact on the cost of shopping (and everything actually) is really denting families ability to fund everything. Here we suggest some things that we have been trying to stop costs from spiralling out of control especially as our mortgage will come up for renewal in a couple of months and that is likely to mean a huge hike in monthly costs...

Food Shopping

This is perhaps the area of the cost of living crisis that has hit our family the hardest. This is probably because we are a larger family and so our shopping bills were already huge, but in recent months I would say that this has doubled.

That is not sustainable and so we have been doing the following:

Family Budgets

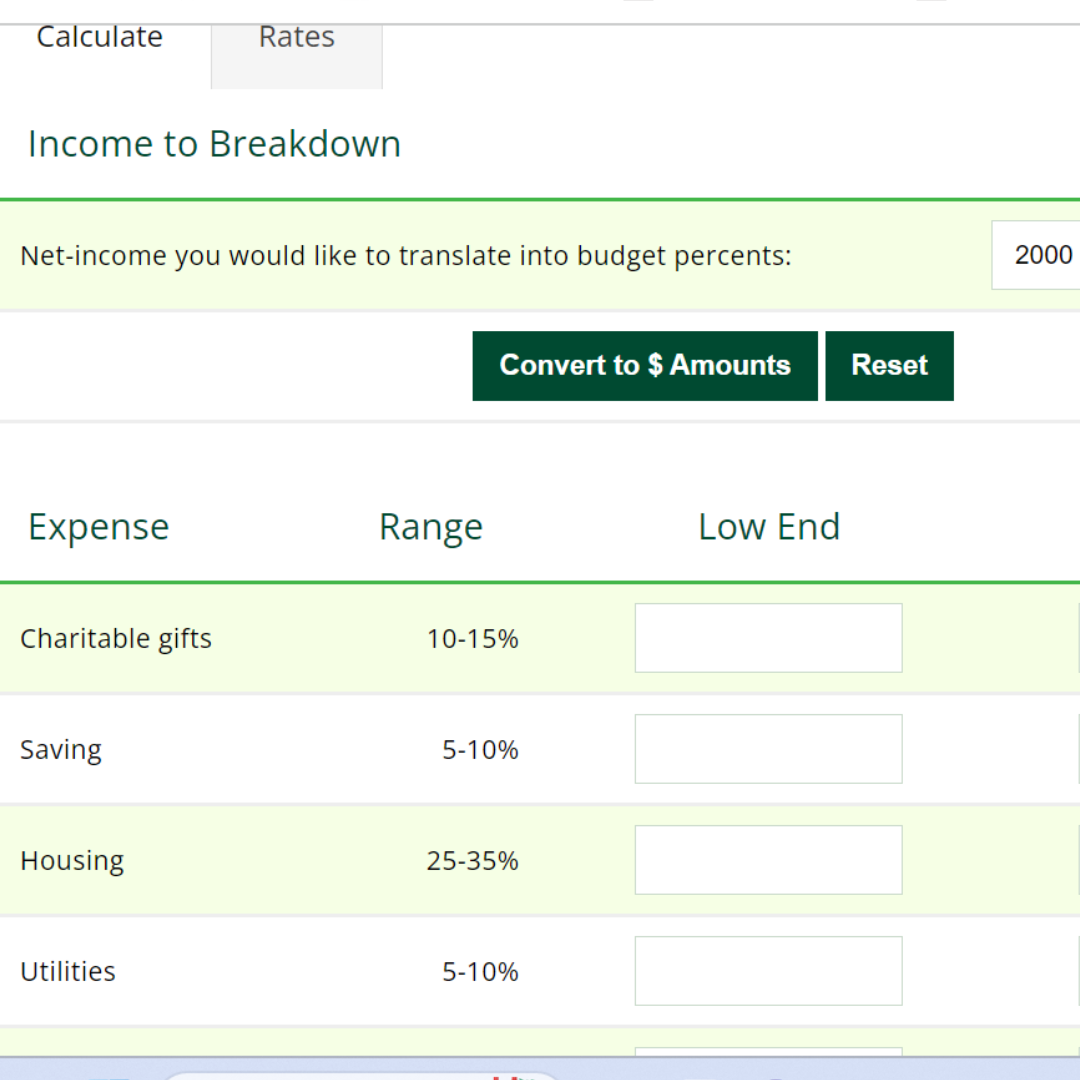

It is perhaps the most important time ever to actually sit down and make a formal budget for your family. There are so many things increasing in cost that knowing what you can and can't afford is so important and it can actually help you save money as well. It can be so daunting to sit down and do this though so a premade budget template is hugely helpful.

This one had everything we needed and did all the calculations for us (maths is not my strong suit so that is major plus for me!)

Vacation Planning

We know that for many people having a holiday will be out of reach next year so we know we are lucky to even be able to be thinking about this, but if you can make a trip work then our top tip is to plan as far in advance as possible.

As soon as airlines release their flights you will get the cheapest deals so it is worth checking how far in advance they come out for the airline you are planning to fly with.

We tend to drive and camp so this is a cheaper way of holidaying, but it still adds up so our plan has been to book early and spread out the costs so we can budget over the next few months to make the necessary payments and enable us to have a great break this summer.

Holidays Planning

The holidays are always expensive, but as with the above items pre planning can really help with the costs of the holidays. Having a written holiday planner and budget really is so important for staying on track financially during this expensive and busy time. As I write this it is mid December so the holidays are totally upon us, but as soon as they finish I will start my savings jar for next year. One of the things we use for budgeting and planning is Hyper Jar which is an online banking app that enables you to create as many 'jars' as you like to help you to save for individual items so once you have done your family budget you can get started.

You also might like the savings calculators we found here:

There are loads to choose from and you can plan savings for specific items such as college fees or work general annual savings plans. Seeing it all laid out and calculated helps you to see the difference even small savings can make in the long term.

Have you ever tried the penny challenge? This really worked for us this year. Each day you save one penny more so on the 1st January you save 1p, the 2nd January you save 2p, the 3rd January you save 3p and so on until the end of the year when you will have saved over £600. I did this for half the year and used the money as extra spending money on our summer holiday. I will definitely be starting again on the 1st January.

Mortgage Planning

Now this one is a biggie for so many of us at the moment, especially in the UK where interest rates have spiked. If your mortgage deal is coming to an end shortly know that you are able to secure a new deal up to 6 months in advance of the end date and the bank have to honour it, but if things change with the interest rates you can decide even right before the start date that you want to take a different deal.

This is so helpful as it means you can start planning for the change you know is coming whilst still having the option to take a different deal if things change again. With such a volatile financial marketplace at the moment this could be the thing that sets your mind at rest.

We recommend talking to your bank as soon as possible and looking at mortgage calculators to be sure on what you can afford and be able to plan appropriately.

We know it is hard at the moment, but with planning you can make yourself feel more in control and that reduces the stress although it doesn't lower the costs!